For more information on this great product, contact Gary Siegel at Gary.Siegel@cusolutionsgroup.com or at 800-262-6285 x586.

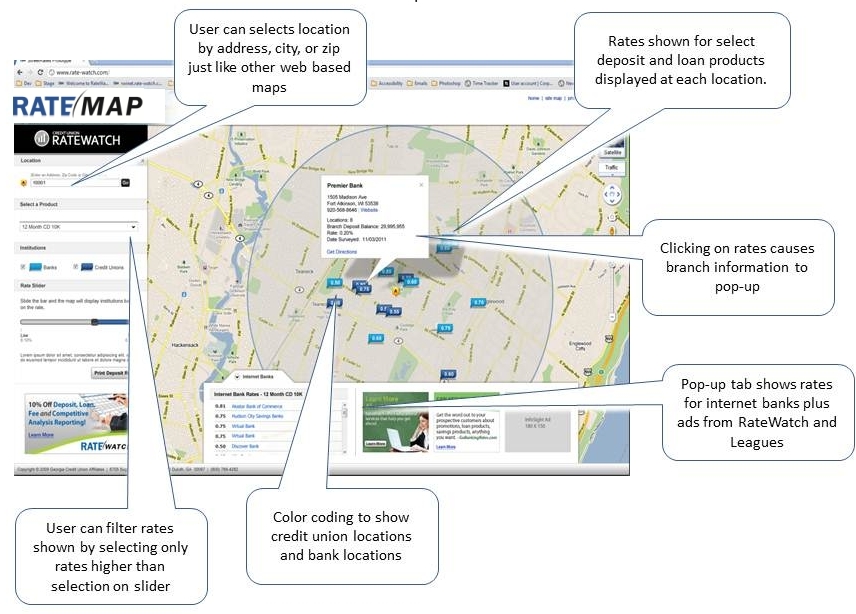

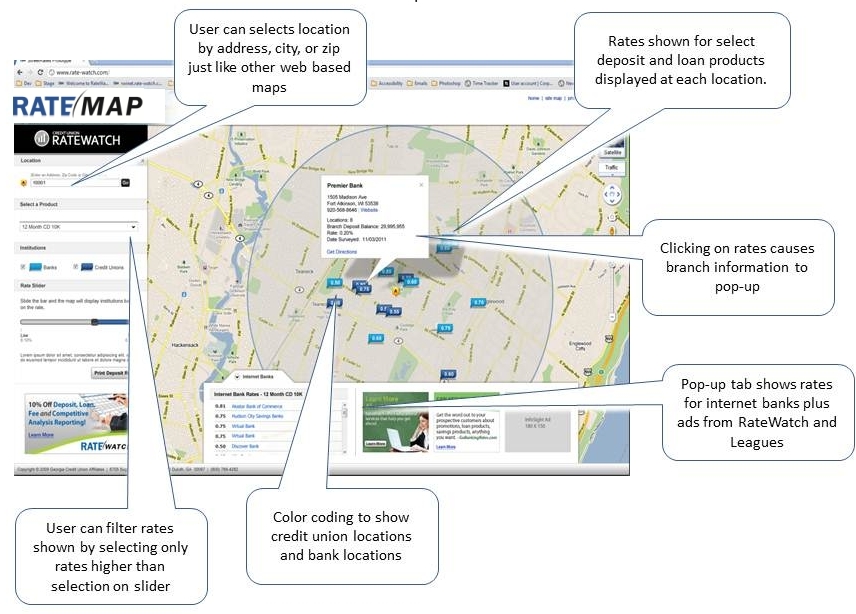

In today’s ever-changing rate environment, competition is fierce. Give your credit unions a competitive advantage on the banks in their community, county, or neighborhood by giving your members access to RateMap. It is a new, unique web-based pricing tool offered in collaboration between League InfoSight and RateWatch that you can deliver as a benefit of membership—branded under your league.

RateMap provides your member credit unions the online tools to see what key rates other financial institutions are currently offering. The insights gained from it will help decision makers to determine what products to offer and how to price them so they can continuously meet and exceed their revenue and profit goals.

|

Product

Features

- Rates for a selection of the most commonly offered deposit and loan products

- 12, 36, & 60 month Certificates of Deposit, Money Markets at $2.5K & $25K

- 60 & 72 month New Auto, and 48 month Used Auto

- Deposit rates are updated weekly; loan rates are updated monthly

- Rate coverage of all of the institutions/branches covered by RateWatch

- Deposit rate data on more than 90,000 branches nationwide

- Loan rate data on more than 40,000 branches nationwide

- Filter by institution type, product type, and rate

- Search by address, zip code, or city and state

- View every surveyed branches’ address, phone number, website, number of locations, and bank deposit balances

- Added values include:

- Internet bank rates

- Customer/member reviews from sites like Google, Yahoo, and Yelp aggregated for convenient viewing

- Semi-annual state retail fees report showing fee averages for credit unions vs. banks

- County interest rate averages widget for placement on league website

- Shows the current average, high, and low rates for select deposit and loan products at the county level in each state by institution type

|

Benefits

to the League

- Increase the value of league membership, including exposure to other league services

- Great for use in recruitment and retention efforts

- Provides credit unions continuous and valuable insight into the current rate environment in their local market to assist them with their own pricing decisions

- Provide small credit unions with competitive data that they could may not be able to afford to purchase themselves

- Completely unique product offering designed with the help of credit unions and state leagues

- Assisting those credit unions that have a greater need for support to help them grow

- Discounted offers to other RateWatch services advertisements within the map

|

Benefits

to the Credit Union

- Free and easy access to competitive pricing information

- More branch level rate data available than any other source in the industry

- Convenient access to member/customer reviews from multiple review sites

- Insights into not only user’s institution reviews but also reviews of their competitors

|

Click on image for larger view